Mortgage

5 ways to improve the mortgage process

Tuesday 25 January 2022

by Lisa Moyle

Consumer preference around communication and experience has shifted to digital across many sectors, including mortgage lending. Certain technologies will be crucial to keeping financial service providers relevant to the next generation of borrowers. An analysis by Which? showed an average of 60 UK bank branches were closed every month in 2021. Banks say this has

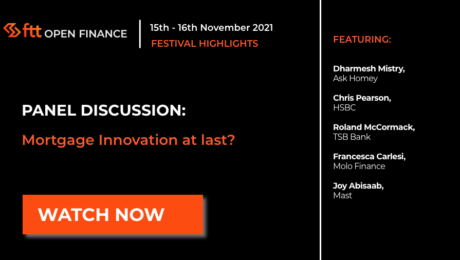

Is open banking really changing the mortgage game?

Tuesday 14 December 2021

by FTT Team

Open banking has had a huge impact on many areas of lending in the recent years. Faster and better informed decisions, a wider variety of products and greater customer approval are some of the benefits that open banking has achieved. But, as we sat down on the FTT Open Finance stage at the Fintech Talents

- Published in Content

Fintechs and AI – A smart move for building societies and credit unions

Tuesday 27 July 2021

by Our Community

Fintechs and AI – A Smart Move for Building Societies and Credit Unions There’s seemingly no end to the business applications of artificial intelligence. From fraud detection to forecasting sales and analysing consumer behaviour, AI has rapidly become a powerful tool for enterprises across the world. In recent years, building societies and credit unions have

- Published in AI/Machine Learning, Content, Customer Experience, Featured, Fintech, FTT Building Societies, Identity, Innovation, Opinion, Robotics

Tagged under:

ai, banks, Building society, chatbot, Credit Union, Financial, fintech, Mortgage, Splash

Top four wins with open finance in 2021

Monday 19 July 2021

by Our Community

The value of Open Finance is becoming clearer as an increasing number of start-ups and established players are innovating in the ecosystem. From tax filing to subscription management, mortgages and credit risk, this article will run through some of the most impactful and interesting Open Finance use cases. Tax filing While nobody enjoys filing their

- Published in Content, Featured, Fintech, FinTECHTalents, Innovation, Opinion