As the summer of 2018 comes to an end, we have gone to our community once again to see how they feel about the encroaching tide of automation, artificial intelligence and ‘bots. Whether they are advising you on your investments or chatting with you via a customer service inquiry – chatbots, AI and robo-anything is settling in as the go-to future for customer engagement, retention and attraction.

Forget blockchain, cyber security and platforms, the tech that really gets the FinTech-erarti gushing today are robots.

So how did our FinTech community feel about the ‘bots? We are going to put our analysts’ cards on the table and say, ‘cautiously optimistic.’ Let’s examine.

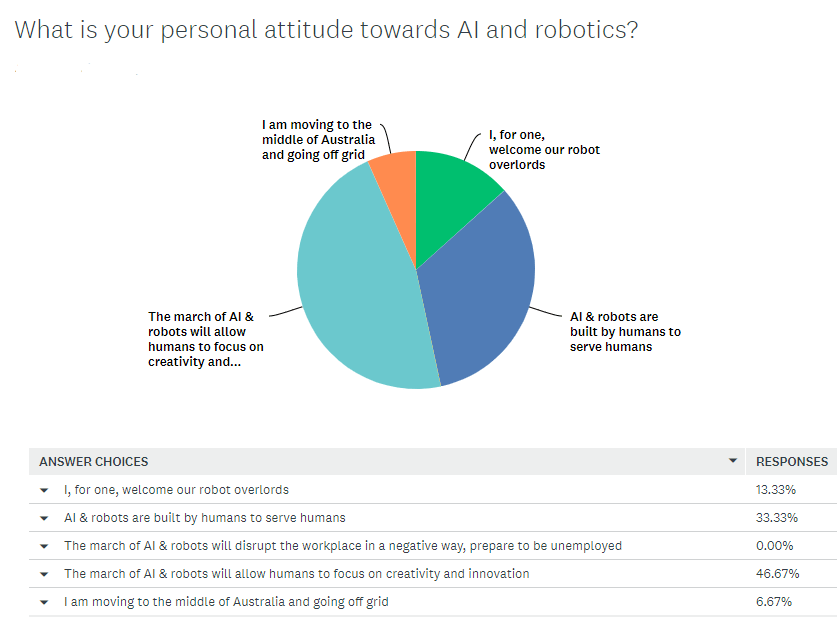

Almost half of our respondents believe that the march of AI and robots will allow humans to focus on creativity and innovation. While a small percentage both welcome our future robot overlords and plan on moving to the middle of Australia to live ‘off grid.’ Most optimistically, no one felt that AI will disrupt our current workplace in a negative and no was planning on becoming ‘unemployed’.

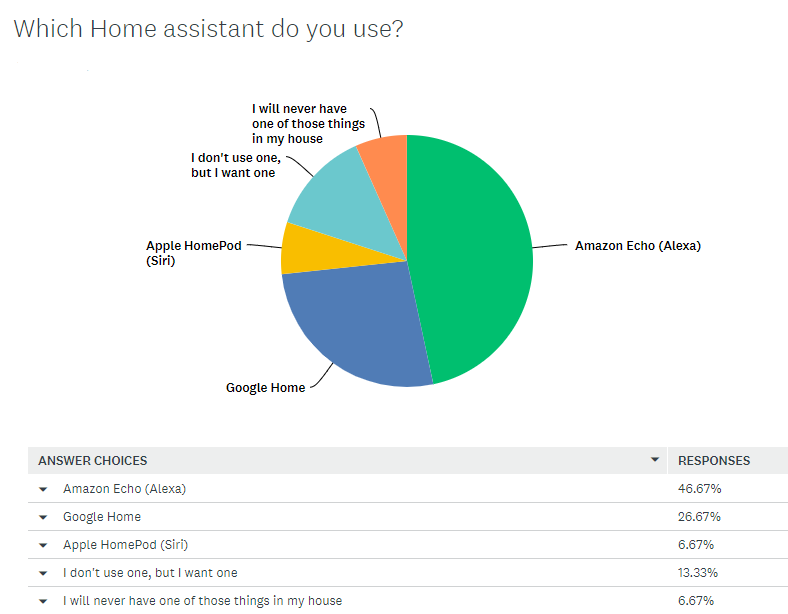

As for AI in our personal lives, the home assistant most likely to reside in the homes of our community was Alexa, the personification of the Amazon Echo. Google Home came a respectable second. However, a small percentage of respondents claim to never want a voice activated, AI machine in their house.

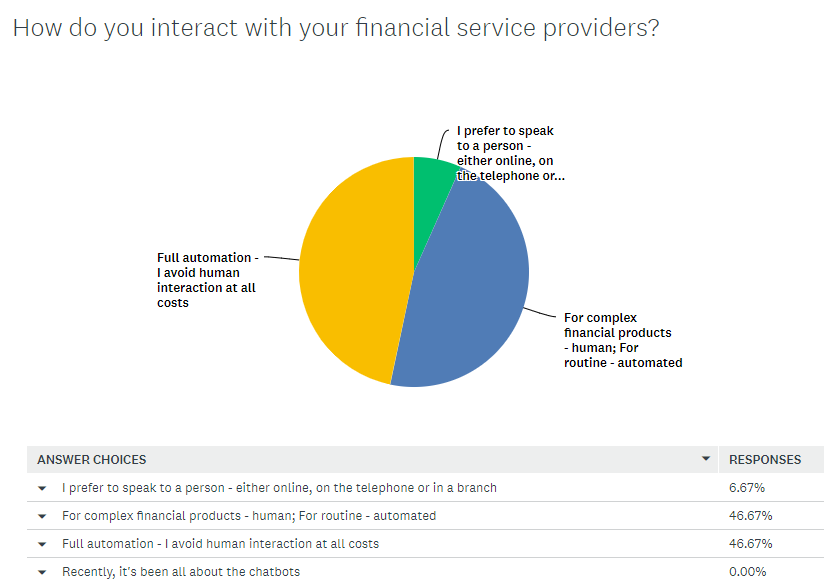

Automation and self service won big as almost 95% of those surveyed had positive feelings about avoiding human contact when interacting with their financial service providers. Almost 50% sought full automation for customer services, while the other half opted for automation for routine requests – leaving only complex queries for human interaction. A small contingent held out for real human conversation, whether it be online, via the telephone or in a physical branch.

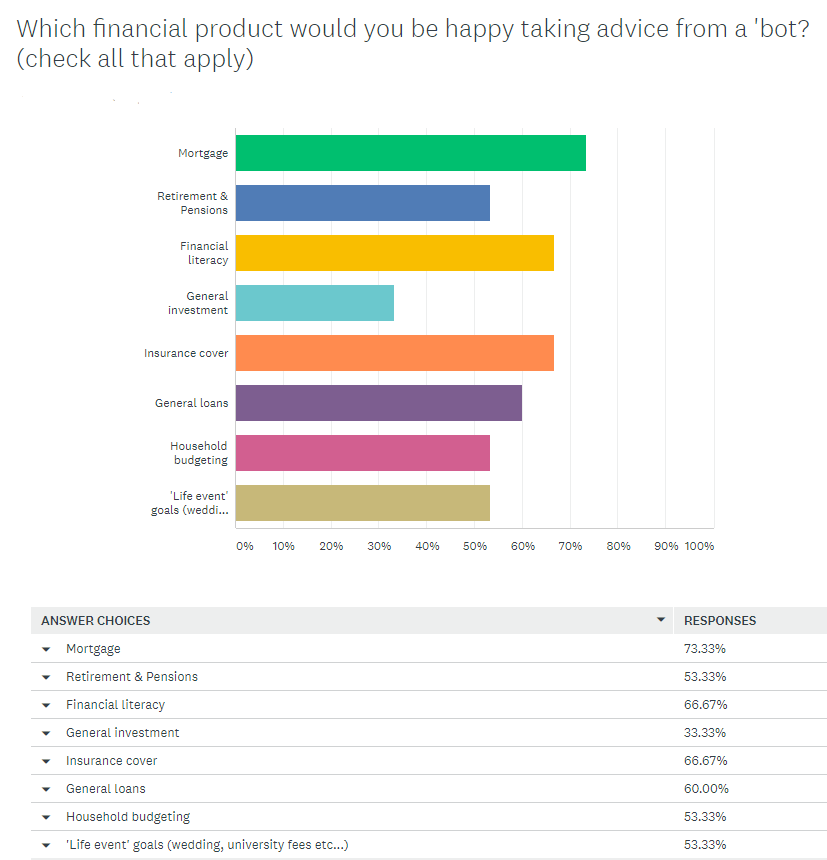

Given the rise of robo-advisors in the investment space over the past few years, ‘General Investment’ garnered the least number of votes when our community was asked ‘Which financial product would you be happy taking advice from a ‘bot? The three top slots for ‘bot-based advice fell to ‘Mortgages’, ‘Financial Literacy’ and ‘Insurance Cover’. Generally, dissatisfaction with the housing and mortgage market may explain why so many respondents were happy to receive, non-human, advice.

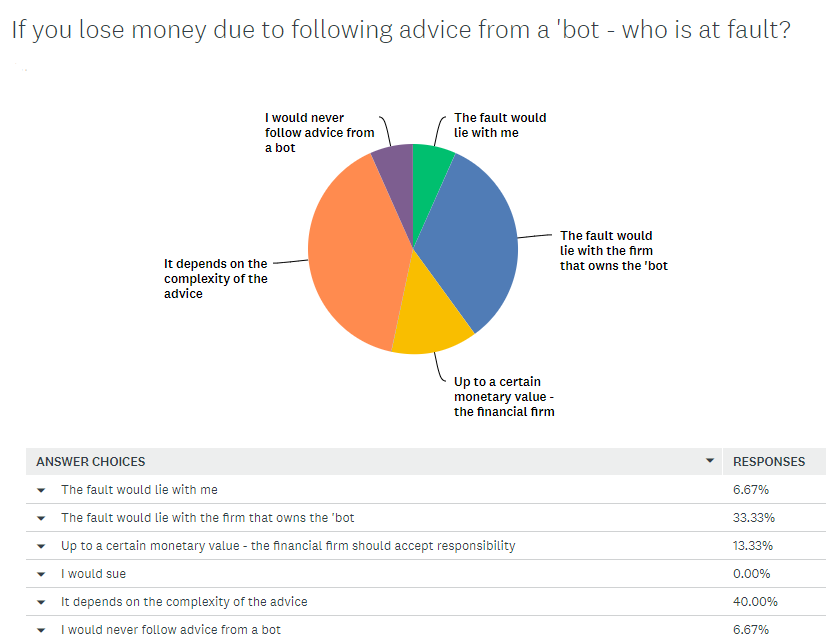

The final question in our Snapshot Survey concerned liability. As we increasingly receive information and advice from automated or AI-based sources – who is liable if that advice causes a loss of funds? The majority of our community responded that liability would depend on the complexity of the advice, but that fault for any losses should remain with the owner of the robo-generated advice.

Watch out next week, as our community goes back to school and we look at the digital skills gap in the UK.

Join us for two days of innovation, collaboration, live stories, music & craft beer at FinTECHTalents at HereEast, London this 30th & 31st of October.