In 2020, the banking industry focused its attention on quickly shifting tried-and-true business models to accommodate restrictions related to the Coronavirus pandemic. A year later, virtual experiences are now the norm and financial leaders are looking toward a post-COVID future. The road to recovery in the banking sector will be a long one – requiring not only a shift in organizational thinking but a reimagining of how banks operate and compete in 2021 and beyond.

A different perspective

The effects of COVID-19 will be felt for years to come, even if life eventually returns to “normal.” In banking, however, there may never be a “normal.” A report by IBM suggests, “The different normal touches every corner—virtual and otherwise—of financial institutions. Organizations need to adopt both a holistic perspective and a granular approach. They need to transform operations end-to-end to achieve structural cost savings, succeed with extreme digitization on the cloud, and achieve operational resiliency.” Banking industry leaders are in a position where they must understand that the only economic certainty they can plan for is uncertainty. Priorities will lie in ensuring uninterrupted and streamlined services for banking customers in the event that the economy takes a turn for the worse and sudden demand for financial assistance skyrockets again.

What does this mean for banks looking to compete with emerging fintech startups?

It’s time to get creative and nimble. This rings exceptionally true for smaller institutions with limited resources like credit unions, says Kelly Wagner-Grull, director of innovation & member experience at Credit Union of Colorado. With contingency and customer accessibility top of mind for financial institutions, banks are taking an introspective look at their current operations – identifying opportunities to leverage technology, and using data and automation to create a personalized banking option that delivers on specific customer needs.

Credit Union of Colorado did this well by launching its video banking solution at the height of the pandemic. In five weeks, its team created a solution leveraging existing technology to deliver a collaborative and consultative experience that kept members safe. Once a minimum viable product was in place, the team was able to look deeper and identify ways to continue delivering on what the member experience should be and improve upon it. By creating a personalized experience that effectively mimics the human connection with a banker in the physical world, IBM states that this model will generate its own unique value by “understanding how digital relationships can truly create closeness and positive impact even during crises such as a pandemic lockdown.”

Banks looking to keep up with their fintech counterparts in 2021 and beyond must consider the time and investment necessary to create personalized digital experiences. According to CDC Federal Credit Union President and CEO Australia Hoover, choosing a path towards digitization will require a clear understanding of the overall end goal.

“Don’t be afraid to take a chance to make someone’s life better. If you fail, fail fast and move on quickly. Learn from early mistakes and improve upon them as you go. The other side is usually much better than where you started,” said Hoover.

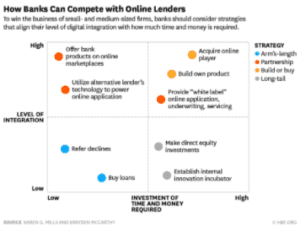

Harvard Business Review neatly outlines potential tactics for banks to consider in executing on this journey. In a competitive environment where speed and efficacy is critical to long-term success, traditional banks would be best suited to shift away from identifying fintechs as direct competitors looking to eliminate the very existence of legacy institutions. Instead, banks must collaborate and partner with emerging fintechs to create mutually beneficial relationships. By working together to solve a common goal – contingency and accessibility – these organizations will be best equipped to meet the needs of their financial customers.

Creating partnerships that capitalize on both the legacy and recognition of long-standing financial institutions and the speed and agility of highly specialized fintechs will supercharge economic recovery efforts and secure the longevity of banks for future generations.

What’s next?

In the digital era post-pandemic, banks must continue to embrace technology and remain focused on the most important task at hand – providing continued essential services to their customers. In order to do this effectively, banks should see fintechs less as the opposition to be destroyed and more so as additional reinforcements. Embracing the highly specialized roles of fintechs and leveraging similarities in company DNA will ultimately provide a sense of ease and security for the end user.

Cassie Gonzalez, Senior PR Associate, KCD PR.