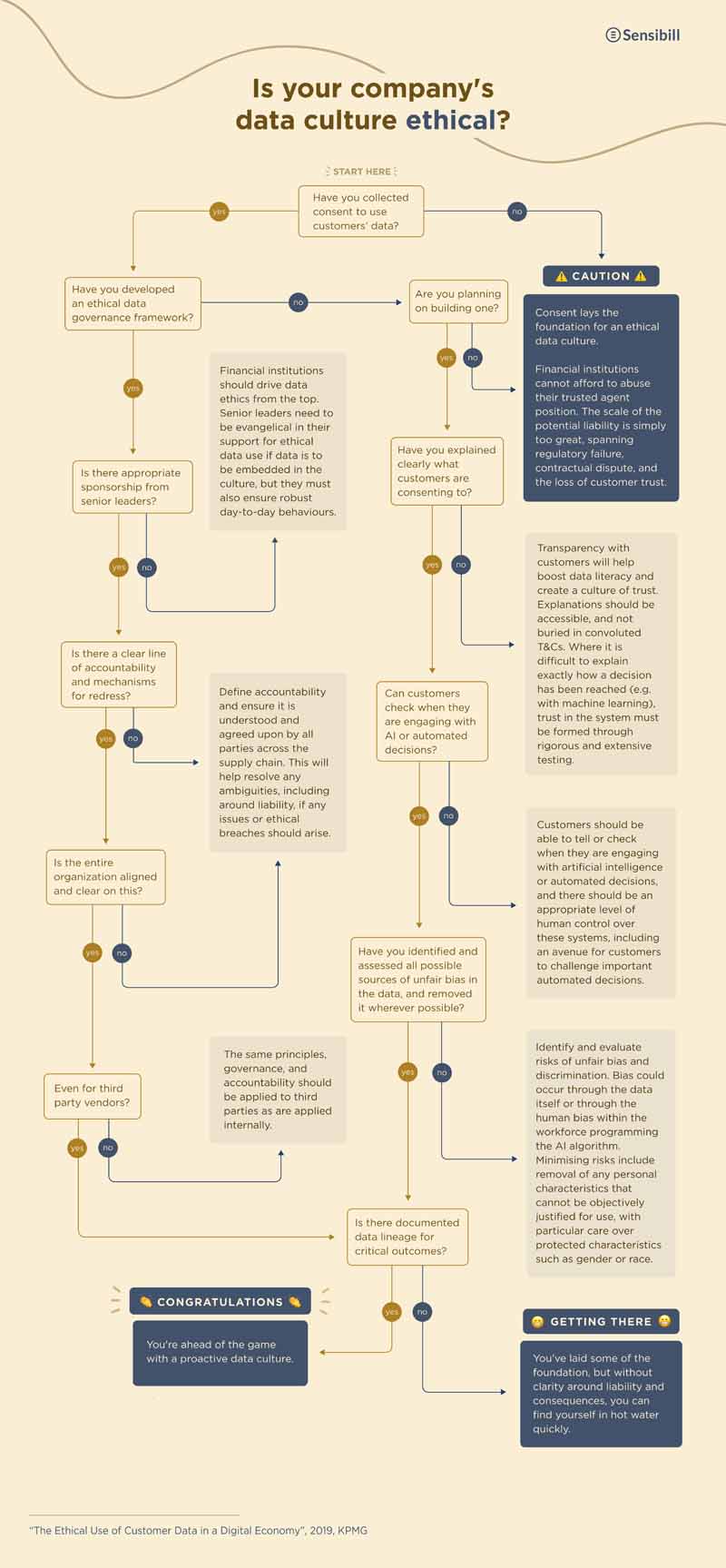

Our friends from Sensibill made you a flowchart to find out.

Thanks to Silicon Valley, we have plenty of examples of what it means to not have an ethical data culture. Uber’s “God View”; Facebook’s Cambridge Analytica scandal; Google’s hacked Nest cams. And while hefty fines and public outcries are helping drive some change, it’s starting to feel like regulators are always playing catch-up after the next exploitative innovation.

Understandably, consumer trust is at an all-time low. For organizations that handle sensitive data, such as financial institutions, this presents an interesting opportunity: establishing trust as a key point of brand differentiation.

A proactive ethical data culture could restore a lot of confidence in the eyes of consumers who are still reeling from the Financial Crisis of 2008 (and the unfortunate slew of scandals since).

Historically, banks were viewed as the custodians of their customers’ data—information to protect, not an asset to commoditize. Of course, that’s all changed with fintech, AI, and regulatory changes like Open Banking in Europe. Banking technologies now cull and crunch all sorts of customer data—financial, social, geographical—to give personalized financial advice, make product recommendations, approve loans, and much more. The requirement to share data with regulated third-party providers at the request of the customer poses an additional risk for financial institutions’ reputation should any breaches arise.

In the absence of a centralized framework, incumbents have an opportunity to lead the charge in ethical data management and secure their role as trusted agents in customers’ lives.

Which brings me back to my original question: What does it mean to have an ethical data culture? And does your organization have one?

Sensibill made you this flow chart so you can find out for yourself.

Meet Sensibill – one of our 2019 FinTech Stories companies – at FTT19 this November.