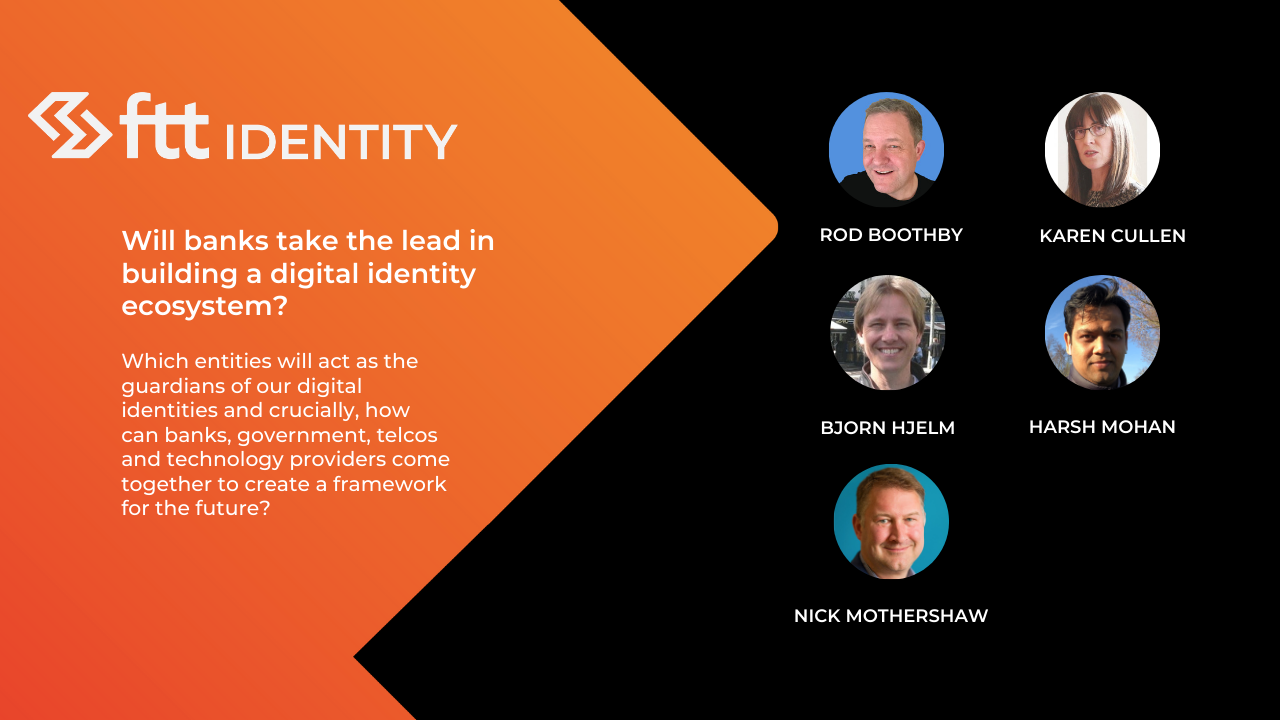

FTT Identity 2021 began with a big question – which entities will act as the guardians of our digital identities? The opening panel brought together an expert group well placed to tackle this complex debate, representing between them financial services, government, telecoms and the identity industry.

They considered whether responsibility would fall to national governments, or if there’s a possibility that Big Tech could take a leading role. Or perhaps, whether heavily regulated data usage, established KYC functions, and higher than average consumer trust, put banks in a unique position to close the identity gap.

One thing all panelists agreed on, is that collaboration and interoperability are absolutely crucial for progress. As is the ability for each individual to have greater control over the guardianship of their own identity, and be able to use this for different services, in different countries, moving forward. The question we are left with is how can policymakers, the private sector, NGOS and industry associations come together, as we build an identity framework for the future?

The Rockstar speaker line-up for this session featured:

- Rod Boothby, Global Head of Identity, Banco Santander

- Karen Cullen, Head of International Financial Services, Risk & Compliance Unit, Department of Finance Ireland

- Bjorn Hjelm, Vice Chairman, Open ID Foundation and Distinguished Member of Technical Staff, Verizon

- Harsh Mohan, Global Principal, Platforms and Beyond Banking, ING Bank

- Nick Mothershaw, Chair and Chief Executive, Open Identity Exchange (moderator)

Watch the full session below.

For more on-demand sessions from FTT Identity 2021, visit Future Identity – a new community brand exploring the latest initiatives, technologies and concepts driving universally trusted identity.