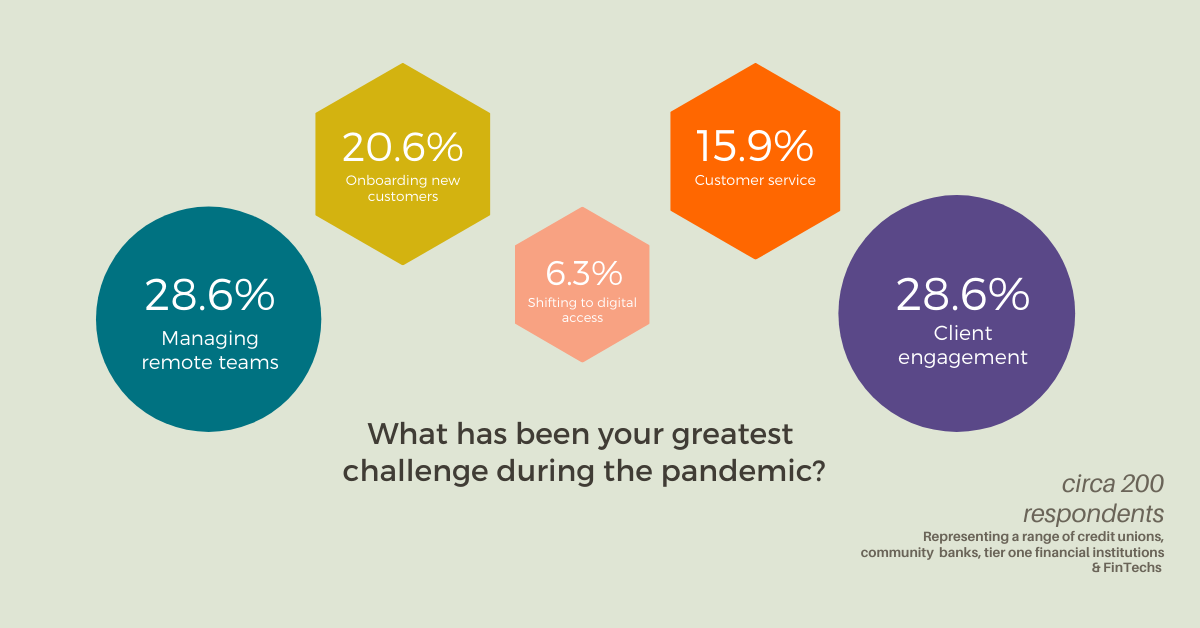

What has been your greatest challenge during the pandemic?

- (28.6%) Client engagement

- (15.9%) Customer service

- (20.6%) Onboarding new customers

- (28.6%) Managing remote teams

- (6.3%) Shifting to digital access

During FinTECHTalents North America, the team ran several polls across the day. We asked our attendees a broad range of questions, from their favourite speaker quote to how long they had had the same cell phone number. One of the results that caught my eye was the one noted above that asked about specific business challenges brought about by the pandemic.

Not surprisingly the impact of Covid-19 was addressed by speakers and featured in every discussion during the event. Whilst news of the novel virus was starting to appear in headlines from December, the impact of shifting to remote product/service access and working across the financial services sector with little lead time was profound. With six months behind them, speakers and delegates were able to assess the challenges and changes to their business they had faced.

We didn’t include an ‘all of the above’ option – as some participants noted on the day – as whilst we recognised that the effects would be felt across the business, we were keen to find out how respondents rated those challenges. Of course, the starting point impacts how companies were able to respond to the changes required due to lockdowns and other virus mitigation measures. Providers who had already adopted new technologies and ways of working prior to the crisis that made, for example, onboarding new customers a digital process and had rolled out (or were in the process of doing so) digital channels for customers were in a stronger position. The crisis may have created an urgency to those digital programmes and, as Jim Marous, Co-Publisher of the Financial Brand, noted, exposed those that were ‘faking digital’ but, strategically, if you hadn’t started on the process then you faced a much more challenging landscape.

Customer service challenges for many financial institutions were evident from the early days of the closure or limitation of face to face services and the concurrent economic disruption. Whether unable to carry out tasks that were once done in person or facing financial stress due to the looming economic crisis, customers contacted their financial institutions in droves as the ripple effects of the pandemic were felt across society. The stories of customers on hold for long periods of time or asked simply not to contact their provider were abundant. Providers of technology solutions to support customer services teams, who were working remotely as well, saw a rapid increase in demand. From small credit unions to large, multinational institutions, the increased demand/volume on call centers was raised and discussed throughout the event. The same held true for digital providers who may well have been ahead of the game in digital provision but whose teams (including customer services) were located in physical offices.

It is perhaps not surprising that the challenge of managing remote teams shares top ranking in the poll. What was a trend in allowing more flexible working became a mandate. The need to re-organize and make sure that employees had the necessary tools was just a first step, albeit a big one, in response to the crisis. This presented particular challenges for regulated institutions and the need for oversight and ongoing compliance. Hans Brown, Global Head of Enterprise Innovation and Global Chief Information Officer for Corporate Technology at BNY Mellon, noted the work of his colleagues in enabling people to shift to remote working in short order during his fireside chat and it was a topic considered by participants throughout FTT Virtual North America.

The shift to remote working required a cultural and management shift that necessitated an increasingly broad range of tools – communication, productivity measures, security and employee onboarding, retention and well-being to name just a few – that are still being determined. As we enter a new phase of the pandemic and with some work from home measures being re-activated or continued, remote working will be the norm for many for some time to come.

Looking at client engagement – which shares top slot with remote working – it is clear that for businesses to survive and thrive, meeting the needs of current and future clients is a priority. As we all look to ways to reach those currently in our community and to bring new people into the pipeline, creativity and digital technology go hand in hand. Educating, informing, and providing the type of technologies that enable businesses across the sector to meet the needs of clients digitally and virtually are trends that are here to stay for the foreseeable future.

Looking ahead, the post pandemic world is not going to shift back in a similarly dramatic fashion to previous ways of working even when the challenge of the current health crisis has abated. New ways of engaging clients – whether working from home or back in an office – will be an enduring feature of the financial services landscape and one that will continue to provide ongoing opportunities for innovators to meet those challenges.