ING and CBA Pinpoint MiFID-II/MiFIR Obligations in 2.5 Minutes Using Ascent.

Regulatory compliance programs cost financial firms billions of dollars annually. Much of this cost is a result of the exhaustive amount of time required to manually analyze regulations and determine how it impacts the firm — a laborious process that starts all over again with every new change in regulation.

ING and Commonwealth Bank of Australia innovate using Ascent’s Regulation AI.

In a groundbreaking pilot, ING Bank and Commonwealth Bank of Australia (CBA) collaborated with Ascent to demonstrate the ability of its market-leading technology to create massive efficiencies and cost-saving opportunities for the two participating global banks. The project was overseen by the UK’s Financial Conduct Authority (FCA).

Ascent’s Regulation AI produces regulatory obligations faster and more accurately than humans alone.

In only 2.5 minutes, Ascent completed a stunningly accurate review and analysis of MiFID-II and MiFIR, a process that took ING and CBA 1,800 hours of manual human effort — roughly equivalent to one full-time employee, one full year. The project’s collaborators agreed the pilot provided clear evidence of the enormous existing and future potential for AI-driven automation in the financial compliance industry.

Ascent vs. the status quo

ING and CBA underwent a painstakingly manual process of creating traceability matrices which mapped the banks’ own understanding of their respective regulatory obligations and requirements under MiFID-II and MiFIR. Law firm Pinsent Masons was also asked to perform a separate, independent validation.

When lined up against the benchmarking work conducted by ING, CBA, and Pinsent Masons, Ascent’s output was proven to save hundreds of hours of manual effort with pinpoint accuracy. Ascent’s proprietary Regulation AI rapidly linked each bank’s business lines with their corresponding regulatory obligations under MiFID-II/MiFIR across seven regulatory scenarios.

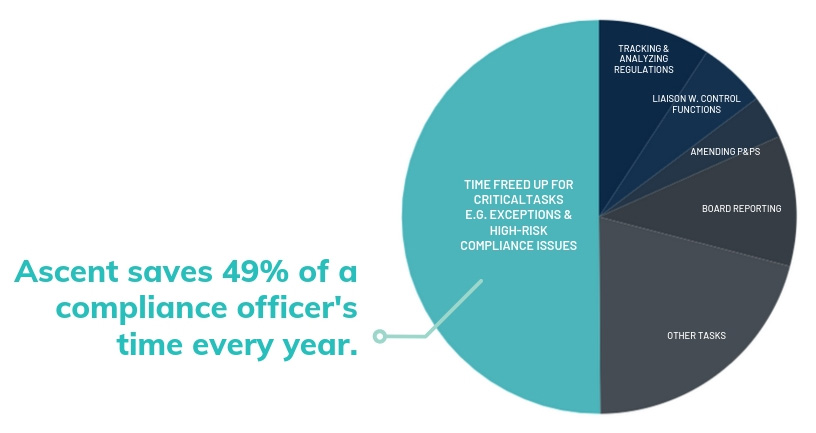

In other words, Ascent performed as well or better than human experts in a mere fraction of the time. In fact, Ascent has been shown to result in a time saving of 49 percent per compliance officer per year, freeing up valuable time to proactively handle exceptions and high-risk compliance issues.

Conclusion

The pilot project represented an enormous leap forward for ING and CBA in terms of compliance task efficiency. With Ascent’s Regulation AI now parsing and systematizing regulatory text, firms can now reallocate human capital to more critical job functions, saving time and money while empowering teams to accelerate their compliance programs.

“We are proud to have taken part in this state-of-the-art pilot that brings major industry players, regulators and new technologies together, to explore solutions to challenges we all face today.” —Ian Hollowbread, Director, Enterprise Office, ING UK

Meet Ascent at FinTECHTalents and RegTECHTalents this November at PrintWorks.