Gilad Amir, Operating Partner for Technology, Pollen Capital

In my previous blog, I tried to share some of our perspectives on digital transformation and its key components through the lens of our Private Equity experience. One important point I (consciously) didn’t elaborate on was the desired end state — what does a successful digital transformation process look like? Or simply put: what is the digital nirvana?

Digital transformation is tricky, as it’s an always-on process, with constantly changing and sometimes illusive targets. Between the knowledge gap of Boards and Executives, to consultants, who often don’t add clarity, it’s hard to see the forest for the trees.

At the abstract level, technology transforms industries and organisations from discrete to continuous, and in doing so, unveils the gaps in the organisational and value-chains in much shorter cycles, and places organisations in their natural place in the food chain. As “it is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change” (Darwin), those organisations that can’t constantly adapt in a digital world will go extinct.

In practical terms, this means that digital transformation is not about customer journeys (a common belief in some of the incumbent, larger banks), data, agile or even BPO. As important as those tech enablers are, the key to successful digital transformation lies in designing and building an operating model that will allow the business to constantly change and evolve around customer needs and market dynamics. Ultimately, in a world where change is the only constant, the end state of digital transformation is a sustainable change model.

In reality, the digital nirvana feels more like a Tabata class…

Embracing the no-comfort zone

Redesigning the organisational DNA — transforming a business from an analogue/ static business to a constantly changing digital business — is a journey. It requires, above and beyond the tech build, the business to rewire the organisation to sustainably operate in the fast-changing digital world.

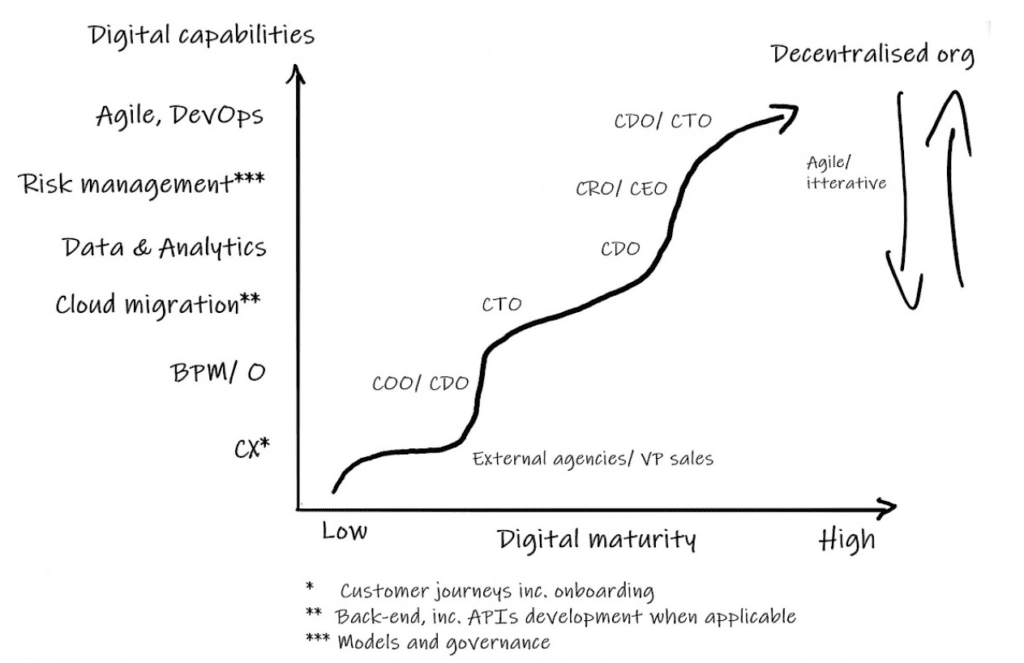

The following diagram illustrates the typical digital journey and resulting evolution, major milestones and ownership of/accountability for each:

As illustrated in the diagram, our experience has taught us that building the right technology is merely a prerequisite. The real value is created when the technology underpins the business and is being utilised by suitable organisational structures, methods and values. This state of dynamic tech — org-structure compatibility is the ultimate goal of digital transformation and translates the tech capabilities into superior financial performances and business adaptability.

As illustrated in the diagram, our experience has taught us that building the right technology is merely a prerequisite. The real value is created when the technology underpins the business and is being utilised by suitable organisational structures, methods and values. This state of dynamic tech — org-structure compatibility is the ultimate goal of digital transformation and translates the tech capabilities into superior financial performances and business adaptability.

In the following sections I’ll try to elaborate on some of the challenges and trends we have been seeing, and some proposed ways to address them.

Command-and-control is dead, long live the decentralised organisation

In a world where the potential loss from standing still outweighs the risk of making mistakes, the goal of digital transformation should be to create a sustainable digital change model. This requires businesses to focus on building technologies and compatible organisational structures and delivery methods that enable change at pace, and adopting suitable HR, GRC (Governance, Risk and Compliance) models and system thinking capabilities.

While I doubt Aragon will turn into the operating system of FS providers anytime soon, it’s clear that the only way to build business adaptability and sustainable change capabilities is to create autonomous functional units within the business. As the central change models are obsolete, primarily as they are too far from the customer and too slow to respond, the digital adaptability should be democratised. A sustainable change model can be achieved by smaller, autonomous front-line teams that are supported by central functions (IT, procurement, finance etc) with tech enablers, new incentives models and suitable GRC frameworks. In addition, this change requires the HR function to design methods that put the team (rather than individuals) front and centre, as they live and die as a team.

As the industry is brainwashed with Agile, it should be clear that true agile can only be achieved when an organisation’s technologies, structure, incentive models and GRC frameworks, all enable a decentralised operating model in a coherent way.

The CTO is dead, long live the CDO

A digital transformation process requires CEOs and execs to dynamically manage gaps and incompatibilities between the moving parts. One example of such gap lays in the organisational ability to adopt new technologies and fully utilise them.

I mentioned in the previous blog the commoditisation of technologies and monumental shift of FS from utility to distribution/customer ownership. One of the interesting consequences of these trends is the way businesses adopt technologies and shift in focus from back to middle/ front office, or in other words, the shift from building to extracting tangible value from technology. As obvious as it sounds, the reality is that in most organisations there’s a material gap between the tech spend and how those capabilities cascade throughout the organisation and translate into business value.

One contributing factor to this gap would be the organisation DNA. As challenging as building technologies is for financial institutions, the DNA and cultural change is exponentially more challenging, with the majority of senior leadership teams having a very basic understanding of tech/ digital/ data, and even less knowledge about how these skills can translate into more revenues, new business models, improved efficiency, scalability, etc.

Another factor is the perception of the CTO’s role/ skills/ mindset — CTOs build and procure technologies. Even when they manage to build and deploy it successfully, there is a material gap between the tech and the translation of which into new capabilities and tangible benefits. One could argue that the utilisation of tech is outside of the CTO’s remit, but with over 80% of digital transformations failing, the reality is slightly more complicated than that.

The way to bridge this gap during the transition to a decentralised model, is to support the business units with a Chief Digital Officer. A CDO is a customer and market-facing tech leader, who understands CX/ BPO/ data/ analytics, and who can work with the business units shoulder-to-shoulder on constantly iterating and improving CX/ channels/ data and insights/ automation in very short cycles (aka Agile). Essentially, the CDO role is to help the business extract the value of tech they’ve built much faster and continuously improving it, while developing the “digital muscles” the business needs to democratise UX, BPO, use of data and analytics etc.

Considering the above, the common question about the CDO role would be “can CTOs become CDOs? Or fill both roles?” The answer to which is unclear, as beyond the (bridgeable) technical knowledge, the main difference between CTOs and CDOs is mindset — and more specifically customer centricity and approach to data.

Data at the fingertips

Data at the fingertips

At the basic level, digital transformation means that in the transition from the physical to the digital worlds, data — and the use of which — replaces the human interactions and judgement. Therefore, a digital transformation must result in a data-driven, data-first culture. I use the word culture, as, again, the biggest obstacle to properly use data is the organisational DNA, not technology.

In practical terms, it means that a successful transformation process should enable the digital workforce, at all levels, to access, interrogate, enrich and share data seamlessly and effortlessly. As most employees in a digital organisation are involved in high value tasks, they should have the data at their fingertips.

Going back to the previous point about the CTO-CDO shift, such data capabilities require, beyond the right architecture and technical (BI and AI) tools, a data operating model. The data operating model should define all the actors in the “data production line”, and their remit and controls/ governance. In this context, I should mention BCBS 239 as a regulatory requirement that (with the right approach/ beyond its original purpose) provides a valuable framework for data strategy.

Max (digital transformation impact) = fx (risk function evolution) (or the CRO is dead, long live the CRO)

In my previous blog I referred to the CEO-driven culture as the binary success factor of digital transformation. Being more specific and putting it in the context of building an ever evolving business, it means that ultimately, a business ability to create value via digital transformation is directly correlated to the CEO’s ability to change the business perception and management of risk. Being even more specific, it comes down to the CEO and CRO ability to agree on how to evolve risk management in a digital world, without detaching from the fundamentals or increasing risk.

As risk functions are on the receiving end of the digital pipe, they should be viewed as the ultimate stakeholders and customers of digital transformation. This means a digital transformation process can go as far as their ability to evolve and adopt suitable underwriting and risk methods. In other words, the business ability to generate strategic value from the investment in digital is subject to the overarching, ultimate constraint of the risk function and its ability to evolve.