The successful launch of FTT Virtual North America on September 9th was a function of the community that it was able to bring together. The power of a community sharing knowledge, ideas and even disagreeing, in supporting the creation of better outcomes was evident. In a time of a shared global challenge, the importance of ‘making distance irrelevant’ was on full display throughout the day.

Scott Astrada, Director of Public Policy and Social Impact at Affirm started the day by addressing the State of the Nation of FinTech in North America. His remarks were a powerful reminder of the importance of communities and touched on themes that were addressed by nearly every speaker on the agenda. The impact of the current pandemic loomed large both in his presentation and across the day. The dramatic acceleration of digital transformation was evident but he also noted the importance of recognising the difficulties faced by consumers and businesses across North America and beyond. It was not just the use of technology that was super charged by COVID-19 but also the extent to which fractures in societies were exposed.

At first glance it may seem surprising that issues around social justice – whether based on race, gender, sexual orientation, age, social/economic status or ESG– played such a powerful role in conversations across the day. Yet it became clear that they are the most important drivers in notions of progress and the role of a fast innovating industry. As Astrada noted, businesses need to proactively create the space for new voices to emerge and put a microphone in front of them. Simply creating a space at the table is not sufficient.

Turning to the intersection of policy and innovation, the discussion of Open Banking in North America outlined important challenges and opportunities brought to the fore. Although the panellists felt that the progression of open banking in the United States (American Exceptionalism) would largely be driven by the private sector given the complexity and structure of the financial services sector, our audience poll showed that 63% felt that a concerted policy/regulatory drive would be needed to shift the dial.

As noted by Sam Taussig, Head of Policy at Kabbage, the end-goal of open banking is to drive better information/data sharing and competition, supporting better outcomes for consumers and businesses. That is achieved, ultimately, through partnership and collaboration across a community of innovators and providers. Jeanette Quick, Lead Counsel for Financial Services, Gusto flagged the importance of fairness and understanding when it comes to customer protection as open banking initiatives progress.

Hans Brown, Global Head of Enterprise Innovation and Global Chief Information Officer for Corporate Technology at BNY Mellon who, incidentally, came top of our poll for Quote of the Morning on the Main Stage (Innovation has to happen everywhere) – had a fascinating discussion with Lianna Brinded, Head of Yahoo Finance UK on Re(Building) a Bank that addressed questions of how a very large international financial institution that has existed for 236 years stays innovative and keeps pace with a fast changing industry. He outlined the changes in the demand side, trends accelerated by the current health crisis, and touched on the ways in which he (and the larger organisation) view the resulting disruption as challenging current thinking. Technology, digital mindset and the people/teams who are able deliver are central to the success they have had as an institution on what is a continuous digital journey.

Taking those ingredients for success (people, processes and tools) the lunchtime debate Where is the Heart(land) of Banking brought together an exciting group of institutions (Varo, Cross River, Lead and Radius Banks) that dug deep into ideas of communities and what it means to both understand their needs and best serve them. The passion and commitment were front and center and made the case for harnessing innovations to deliver better outcomes – both to external and internal stakeholders. Again, the onset of a devastating virus flagged the role of informed innovation and the extent to which becoming digital was not a matter of choice but rather a necessity. The speakers made a powerful case for community institutions, updated to comprise a refreshed understanding of how such communities are defined.

Community was also at the center of the discussion around Social Media & Financial Services. Using social media platforms isn’t so much a choice for financial institutions but rather a necessity as that is where customers spend a good deal of their time. The discussion also focused on current issues around social justice and how to ensure that communication, from a brand perspective, was both authentic and worked to build trust. As noted by Denyette DePierro, Vice President & Senior Counsel, Cybersecurity and Digital Risk, Office of Advocacy and Innovation at the American Bankers Association, the products and services provided by financial institutions and FinTechs are the least interesting thing about them (from the customer perspective). During the current pandemic, according to Leslie Olsen, Chief Marketing Officer, Fundbox actually used social media platforms to advocate on behalf of their customers.

To sum up what was a fantastic discussion on the Digital Future of Wealth Management I will simply refer to the song/movie choices made by each of the panelists at the start. Don’t stop thinking about tomorrow by Fleetwood Mac was Rachel Schnoll’s Managing Director and Head of FinLife at Goldman Sachs, choice for a song that represented her innovation mission. Rick Smyers opted for Simply Irresistible by Robert Palmer (kudos for going back to the 80s), pointing to the need for technology to deliver on simplification that makes products both compelling and easy to use. Raul Rodriguez, Managing Director, Innovation Accelerator, Charles Schwab chose a film, Blade Runner, to demonstrate how technology looks to simulate what clients look for from human advisors in a scaleable way. Keeping on the sci-fi theme, Jed Chehlawi, Founder & CEO of TelosTouch, chose Minority Report, noting that client behavior could be anticipated in similar fashion to Tom Cruise predicting crimes. I highly recommend that you watch this panel discussion in full in the event you missed it the first-time round.

Turning to the discussion around Innovating Financial Wellness, a topic which was at the centre of many conversations throughout the day, the panel flagged both the ongoing challenge of supporting improvement to customers financial lives and the increased sense of urgency brought about by both the pandemic. From the impact of ageing societies addressed by Ronald Long’s work as Head, Aging Client Services Center Of Excellence at Wells Fargo to the programs established by Jeremy Balkin, Head of Innovation, HSBC Bank USA to address both financial education and wellness – the importance of leveraging technology and innovative partners to deliver on those goals was front and centre. Bijon Mehta, Global Head of Financial Services at Twilio illustrated both during the panel discussion and in the interactive session that he led later in the day, how technology and customer communication really are key to achieving those goals.

The panel discussion on Supervised Disruption: US Regulators Grapple with Crypto Assets provided some important and actionable insight on the regulators current view as to how they are treated and where they are focusing their attention. With both legal and industry experts participating, it is well worth a listen.

The final Main Stage session of the day – exploring Technology & Ethics – was difficult to bring to a close. It covered so many important topics – including privacy, protection and how to ensure ethical considerations did not go by the wayside. Megan Gordon, Partner at Clifford Chance noted how the regulatory approach may shift following the upcoming US election and there was a lively discussion about how data science can be leveraged as force for good – its true super-power.

From the Main Stage to the interactive sessions that ran across the day, it is worth revisiting all of the sessions. Our partners – Clifford Chance, ebankIT, Twilio, TMT Analysis, Finarb and technicost – delivered great content across the day and value that extended well beyond the virtual borders of the event through the focused clinics offered to attendees.

It was a truly exciting virtual gathering, complete with sound wobbles, punctuated by the ding of slack notifications, forgotten mute buttons and even the cry of hungry twins – FTT Virtual North America hit on all the contemporary tropes and more. If you were unable to join us on the day or had to miss some of the sessions with all that was going on – don’t worry – the content will be available to download shortly.

We are busy working on the next edition already (coming to you on March 24, 2020). To close with a quote referenced by Scott Astrada at the start of the day History doesn’t repeat itself but it often rhymes and we take that meaning to heart as we work to continue the conversation

North America Goes to the Polls

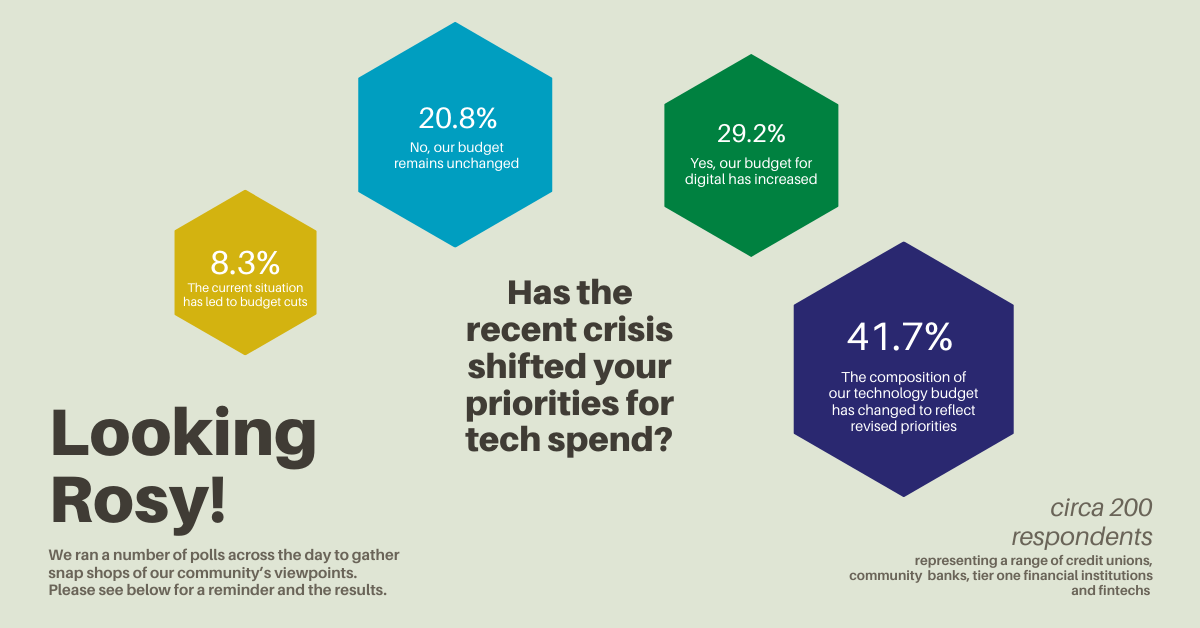

We ran a number of polls across the day to gather snap shots of our community’s viewpoints. Please see below for a reminder and the results.

Welcome to FTT Virtual North America What is your main reason for joining today?

- (32.8%) All of the above

- (4.6%) I miss conferences

- (6.1%) Catch up with fintech colleagues

- (19.1%) Networking

- (37.4%) Content/Education

Has the recent crisis shifted your priorities for tech spend?

- (41.7%) The composition of our technology budget has changed to reflect revised priorities

- (8.3%) The current situation has led to budget cuts

- (20.8%) No, our budget remains unchanged

- (29.2%) Yes, our budget for digital has increased

Can innovators have a positive impact on need/demands for social justice?

- (1.2%). It is too big of a mountain to climb

- (1.2%) Probably not

- (25.0%) Maybe

- (72.6%) Absolutely – lead from the front

Open banking in the US is largely led by the private sector

- (11.4%) What is Open Banking?

- (64.3%) A concerted policy effort/regulatory drive is needed to shift the dial

- (24.3%) This is the way to go for the US Market

Who is best placed to both understand communities and deliver the best set of products and services to meet their needs?

- (7.8%) Who needs a bank, FinTech companies give me what I need

- (17.6%) Scale matters and smaller institutions won’t be able to keep up with large scale incumbents

- (52.9%) Community banks know their communities and, with the right partners, have the edge

- (21.6%) Digital-first providers do it best

What was your favourite quote from this morning’s Main Stage?

- (13.3%) Basically everything said in the Opening keynote – Scott Astrada, Director, Public Policy & Social Impact, Affirm

- (28.9%) “‘Most of our staff are women.’ ‘Childcare is a major issue in the US’ ‘We need to be A LOT more proactive. We need to over invest.” – Josh Rowland, CEO Lead Bank

- (37.8%) “Innovation has to happen everywhere.” – Hans Brown, Global Head of Enterprise Innovation and Global Chief Information Officer for Corporate Technology BNY Mellon

- (20.0%) “The community banks need to have place at the table when talking about Open Banking in the US.” Sam Taussig, Head of Policy, Kabbage

Social Media isn’t new in our lives – is Financial Services still the awkward kid at the dance?

- (10.2%) No – I see banks building community all the time now (2020)

- (24.5%) No – I see just the right amount of social media savvy from my bank

- (38.8%) Yes – but that’s OK

- (26.5%) Yep!

On behalf of our partners at TMT Analysis, we would like to know for how long you have had the same cell phone (mobile for our UK attendees) number?

- 13.5%) More than 25 years

- (59.6%)11-20 years

- (11.5%) 6-10 years

- (15.4%) 0-5 years

What has been your greatest challenge during the pandemic?

- (28.6%) Client engagement

- (15.9%) Customer service

- 20.6%) Onboarding new customers

- (28.6%) Managing remote teams

- (6.3%) Shifting to digital access