Our partners at Boss Insights collaborated with Carver Federal Savings Bank and Paybby to deliver better outcomes for minority and female led businesses at speed. As Michael T. Pugh, CEO at Carver Federal Savings Bank notes, “More than 40% of black & brown businesses could be at risk for failure because of the pandemic, specifically small businesses, so we know [the Paycheck Protection Program] is extremely important. The support of Boss Insights and Paybby allows us to make a big difference.”

Read more about their work to deliver PPP loans below and at Fintech Talents North America on March 24th (9:00 am EST). Register now to secure your free pass.

On January 11, 2021, the Small Business Administration (SBA) launched the Paycheck Protection Program (PPP). Because of feedback from the first round of PPP, the first week was open only to community lenders who support diversity and minority owned small businesses. Community lenders are specially designated institutions that focus on underserved borrowers, including women-led businesses and those run by Black, Latino and Asian owners and other minorities. Community lenders make up approximately 10 percent of the over 5000 approved lenders.

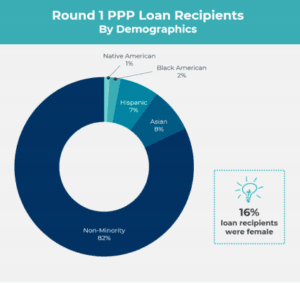

In the first round of PPP, 14 percent of participants identified their background. The results were shocking: only 18% of loans were declared as visible minorities, only 16% were women owned businesses (Source: The Business Of Business).

In this round of PPP, Carver Federal Savings Bank (Carver Bancorp), Paybby and Boss Insights wanted to do something about this. They collaborated to ensure that the PPP funds would be offered to minority owned businesses. As a lender, broker and PPP data platform, they were perfect partners.

As a Community Development Financial Institutions (CDFI), Carver Bancorp has pledged to support community initiatives and minority owned businesses. President and CEO Michael T. Pugh has pledged, “When you deposit your money with [Carver Bancorp], approximately 80 cents of every dollar is reinvested in the communities.”

Paybby is a Challenger Bank built to “empower the Black and Brown communities to build wealth and gain full access to the benefits of banking”.

When Boss Insights was founded in 2017, the mission was to use real time data to empower lenders to accelerate business lending approvals from months to minutes. They’re quoted often for stating that “Data is the Achilles’ heel of bias”. As a minority owned business collaborating with Carver Bancorp and Paybby to support funds getting into the hands of minority owned businesses was a priority.

With the announcement of the current round of PPP, Carver Bancorp based in Harlem, NY set out to ensure that the largely minority owned businesses in the communities they serve would have access to PPP funds in an efficient and timely manner. Carver Bancorp’s President & CEO Michael Pugh commented: “We sought out a technology solution that would speed up the PPP process by automating the application and forgiveness calculations for our business customers along with providing a convenient and seamless solution through loan forgiveness. We’re proud to be partnering with Boss Insights who provided the fully automated application, approval and monitoring platform. With Boss Insights being a minority owned and operated business who offered free technology before PPP was ever announced, we align well on community goals and initiatives and are excited to have established this valued partnership.”

Paybby recently launched the ‘Together We Can’ program to help minority founders process their PPP applications in 15 minutes or less. “Black and brown communities have been disproportionately impacted by Covid-19,” said Hassan Miah, CEO and Founder of Paybby. “With Paybby’s ‘Together We Can platform,’ entrepreneurs, and small business owners can expedite the process of receiving Covid-19 Relief Funding and grants. They desperately need the funding not only to keep their businesses afloat, but to financially support their families and the communities they serve. We’re excited to be collaborating with Carver Bancorp & Boss Insights to support community businesses”.

Boss Insights was involved in the first round and put together a quick how-to guide to help lenders and brokers assess how effective a PPP platform would be. There are only two questions that need to be answered:

1. What technology was the platform providing before PPP?

This will tell you what functionality the platform will have during PPP. The less automated it is, the more manual work the lending officers and borrowers will have to complete.

2. What percentage of the PPP borrowers who completed forgiveness calculations were accepted by the SBA?

Most of the industry reported the number of applications processed on their platform, and not the completed calculations accepted by the SBA. However, looking at the number of forgiveness calculations accepted is a true evaluation of the impact you had for your borrowers. It empowers you to make an informed decision for PPP round

two.

In the first round of PPP, Boss Insights said that social distancing led to social collaboration. The necessity of lenders and tech partners collaborating to support businesses during PPP led to amazing amounts of change in record time. In PPP round two, the amount of collaboration has increased. Boss Insights technology is impactful when lenders like Carver Bancorp and brokers like Paybby collaborate with us to support the community. During round one of PPP, in a Powerful Ladies podcast, Boss Insights was asked as a minority owned business how we could do more to support others. We’re grateful to be partnering with two incredible organizations to achieve real results now and grateful to Powerful Ladies’ Kara Duffy, Ronda Brunson and Sharifah Hardie for planting the seed that led to this reality.

By Keren Moynihan, Boss Insights.