Whether you live by your Twitter lists, save your Google Alerts or simply scroll through LinkedIn for insights and commentary – there is a wealth of content that weaves a global story around FinTech. Our job at FinTech Talents is to work within that global story – finding the news items, conventional wisdoms and hard data that aids us in bringing the industry the best content, community and experiences in the business.

Every week, one member of our content team will offer a rundown of links and posts that filled our content channels over the previous seven days. Our rundown will offer a brief summary of the information, a link to the original post and an insight into why it ‘caught our eye’. All of this aims to offer you a chance to ‘Bookmark’ the timely resources and real time conversations that are shaping FinTech week after week.

This week’s FTT Bookmark is brought to you by Director of Strategy at VC Innovations, Lisa Moyle.

What is in a name?

Older and Wise(er) – Transferwise takes on a new name (it’s now called Wise) to reflect its maturing and evolving focus. I personally find it hard to believe that it has been 10 years since the launch of the money transfer service that has since become one of the poster children for FinTech success in the UK. They have come a long way since one of the founders joined a consultation meeting regarding the FCA’s Project Innovate back when I was leading the Financial Services & Payments group at techUK.

A lot has changed since then, for the company and the broader sector and so have the services offered. They now include multicurrency accounts and Wise business and Platform services.

Oh and there is the much anticipated IPO later this year…

There has been some debate about the merits of the name change but I personally, and this may be controversial, don’t care. Provide me a great service and you can call yourself what you wish.

Nostalgia and Brexit

Name changes, the success and growth of the UK FinTech sector over the past decade and all of the excitement of those early days has got me thinking about the impact of Brexit. In 2014 the government was lavishing praise and attention on the sector- declaring the UK a world leader in fintech, commissioning reports and the regulator was exploring how to best support innovation. Flash forward to 2021 and the Economist wonders if Britain’s fintech crown is under assault.

The focus and attention from government has faded in the wake of Brexit negotiations and other would-be leading FinTech hubs are openly courting businesses. As the article notes, Brexit has exacerbated some of the challenges of a growing sector (eg access to talent) and FinTech is in competition with other affected sectors demanding action from government.

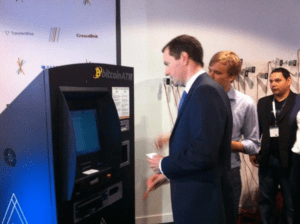

I do wonder what George Osborne did with the £20 worth of bitcoin he took from Bitcoin ATM at the launch of Innovate Finance in August 2014?

The article outlines the opportunity for the next generation of innovators who can provide the infrastructure to a whole new universe of potential providers. Catalysed by a year of lockdowns and the shift to digital channels wherever feasible, digital transformation has been super-charged and pretty much anyone can be a FintTech now.

Making Fintech Great Again

The government launched a “Fintech Strategic Review” last year, led by Ron Kalifa OBE which is being released this Friday.

What to expect from Ron Kalifa’s fintech review suggests that Funding, Open Banking and Regional Hubs for the UK will all be addressed with specific recommendations. These are all important issues and no doubt will be welcomed by the sector, but I can’t help but think that unfettered access to a large market of digital savvy customers and end-users would be very welcome…hmmm, if only.

If the Going Gets Tough

And if the challenges imposed by a no-deal for financial services Brexit get you down, then perhaps you need look beyond the confines of the United Kingdom. UK fintechs seek ‘cure for Brexit’ in Lithuania

“During the Brexit transition period, fintech companies began to search for an alternative EU harbour and thus Lithuania has become one of their primary options,” said Jekaterina Govina, a senior official in charge of supervision at Lithuania’s central bank.

I spoke at a large FinTech event in Vilnius last year (pre-pandemic) and I was impressed by both the number of startups, a very lively ecosystem and clear government support. It brings me back 10 years to all of the action, recognition and excitement about the potential of the UK FinTech sector. Nostalgia and rapid changes – it really has been quite a decade.

Up next week, my colleague Laura Camplisson returns to share her views on a week of FinTech news.