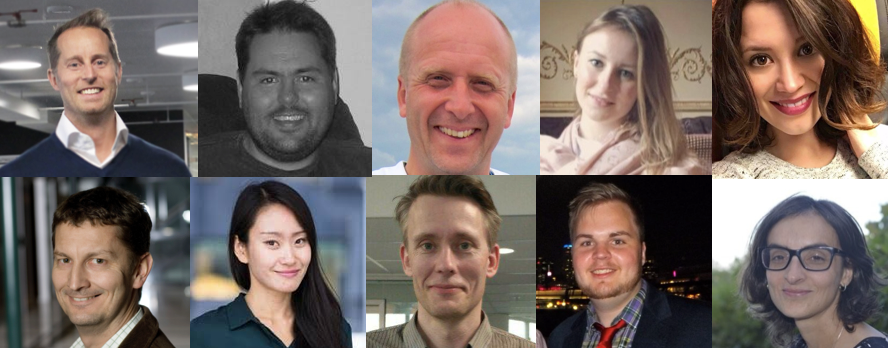

The Neonomics Team

Enabling collaboration and partnerships between banks and new FinTech entrants is the way forward in this era of open banking according to Christoffer Andvig CEO & Co-founder of Olso-based Neonomics.

Christoffer talks about the benefits of running a global team, how entrepreneurship is a constant quest for change and how his preference for craft beer and guitar rock means Neonomics is a perfect fit for FinTECHTalents.

Open Banking and PSD2 are hot topics for our community. Do you think that this can drive significant change across financial services or do they simply put a regulatory framework around a trend that was already happening?

I think Open Banking and PSD2 will absolutely drive significant changes across financial services. We have already seen what is possible in terms of innovation, and regulatory frameworks such as Open Banking and PSD2 are necessary to speed up the process. I hope these trends will lay the foundation for further disruption within the financial industry.

Disintermediation vs Collaboration – is the former ‘oh so five years ago’ or do you think that the challenge is still on in terms of knocking the incumbents down a few pegs?

Collaboration is definitely the way forward, and I hope incumbents can embrace collaboration more going forward or they will experience disintermediation by disruptive startups. Embracing collaboration requires confidence and perseverance as it is something that needs to be embedded in a company culture. In that regard, you could call it a cultural change.

What role does Neonomics play in this evolving ecosystem? Is the clue in the name?

Our mission is to help FinTechs scale like banks, banks innovate like FinTechs by bridging the gap between compliance and innovation. As such, our Interconnectivity Solution is set out to enable more collaboration between these two parties by bringing them together through one unified API under the terms of PSD2 and Open Banking and to perform AIS and PIS both securely and seamlessly. We are in a unique position to leverage these regulatory frameworks to act as a bridge where we can grow a huge network of banks and FinTechs in one ecosystem.

As part of our FinTech Stories Stream at the Festival, we are asking start-ups to share their company story with us. Can you tell us about a key attribute of your team at Neonomics?

Although we are based in Oslo, Norway, we are a global company with a global team. As of today, we count 25 people from 11 different nationalities. Norway, Sweden, UK, Germany, U.S, Pakistan, Ukraine, Spain, South Korea…you name it! We are passionate about blending a unique set of cultural aspects that each and every employee is bringing to the team.

You seem to be involved in a lot of different projects. How do you sustain that entrepreneurial drive? Do you find that you play different roles in different organisations?

I define entrepreneurial drive as constant quest for change to improve the status quo. I play different roles for each project, not so much in terms of a formal manner but more in terms of utilizing different aspects of my personality. But one thing that I do regardless is to always consider different angles and think a few steps ahead.

Dogs v Cats, Craft Beer v Bespoke Gin, Blockchain v Database, Folk v Guitar Rock – would you like to share your preferences?

- Dogs v Cats: Dogs. A fun fact – I am a certified dog trainer.

- Craft Beer v Bespoke Gin: Craft beer

- Blockchain v Database: Depends on the application

- Folk v Guitar Rock: Guitar Rock

Picking up on the last point, would you like to choose a song to add to our FinTECHTalents playlist?

I would like to add Avicii’s “Wake Me Up” to the playlist.