Partner HUB’s Charlie-India platform offers a white label solution for electronic invoice presentment and payment for banks, payment service providers, and fintechs.

The Charlie-India platform was born from the experience of developing invoicing solutions. The founders of the platform started by creating enterprise invoicing solutions, primarily for utility companies. The experience of having had some development projects take months, or longer, inspired the creation of a scalable solution which made it possible to connect companies without individual integration projects.

But, invoicing is a strange beast; each company has a different invoice data structure which contains information from and related to different aspects of the business. This includes data required for tax compliance and data related to the workflow of the issuer (supplier) or the recipient (customer) company as well. Tax compliance varies across countries and, so, adds additional complexity to invoice data structures. For paper-based workflows this was not particularly problematic as invoice processing was manual.

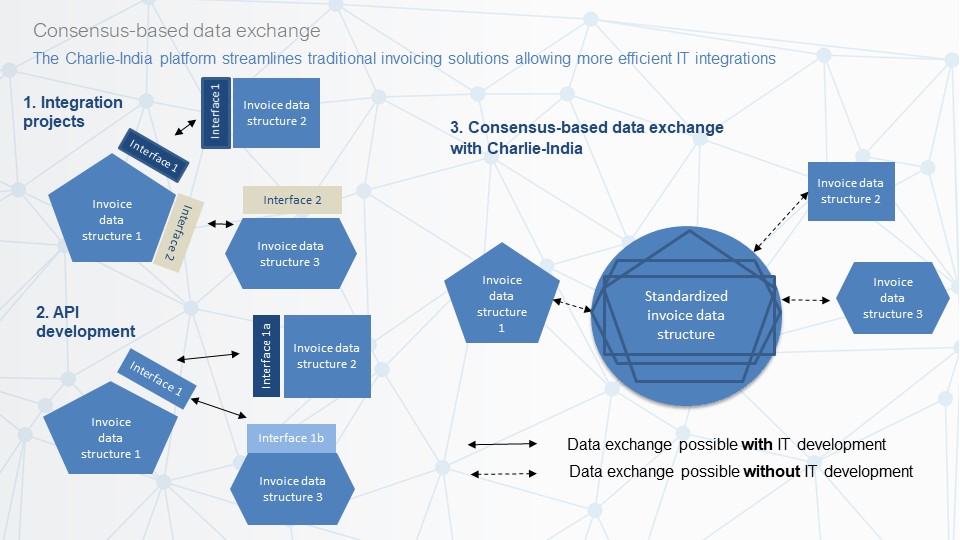

However, with the digitisation of workflows, the need for automatic data exchange for invoicing, both within and among companies, has become crucial. Prior to the introduction of Charlie-India these were being handled by unique integration processes, which were costly and redundant. Invoicing standards existed but they were very difficult to implement for clients as developers at an individual enterprise do not necessarily have the skills and knowledge for implementation. The situation with APIs is similar, as every large company/bank tends to have its own API data structures for which external companies need to develop and adapt their interfaces. Again, this leads to redundant and unique IT development projects and, so, therefore, does not solve the problem.

That’s where the concept of Charlie-India was born; the developers of the platform were inspired to look for a technological solution where the automatic data exchange mechanism relied on a standard but did not require the actual knowledge of the standard on the side of either the sender or receiver. The fundamental and guiding principle was that everyone should be able to continue with their current invoicing structure otherwise the requisite integration projects slow things down significantly.

The result was that the platform itself implemented the UBL 2.1 standard invoice structure, where all invoice related data could be found. Each invoice can be translated to the UBL2.1 standard data structure, the consensus is the UBL based invoice. That simplifies the process significantly and the only requirement for communication is that the sender’s side and the receiver’s side invoice structures need to be mapped to the UBL 2.1 invoice structure. Given, however, that Charlie-India uses dynamic data structures, these mappings do not take more than a few hours and require only parametering of the platform.

The consensus-based data exchange approach supports the creation of decentralized networks. All participants can communicate (exchange data) with each other with the only requirement being the inclusion of the consensus data structure document.

The exciting thing about dynamic data structures is that the principle may be applied to any real or de-facto standards ranging from ISO20002 to health data (HL7); the potential application fields are unlimited.

The result is a general document-based data-exchange platform from which it is possible to launch white label online invoicing solutions in any country within weeks and implement into banks’, large corporates’ or fintechs’ operations very effectively and at pace.