Getting into the FLOW: Rethinking Agile

You’ve all probably read the obituaries , seen the videos from numerous conferences and ultimately received the message that Agile is dead.

But I disagree, Agile is very much alive…….and that is the real problem!

The Agile movement (if one can call it that) picked up pace in 1999 and reached manifesto level at some point in 2000. Synonymous with Agile is the Scrum methodology, which was born in 1986 for product development and first used in software development in the early 90’s.

Therefore, the fact that many large organisations are now just starting to implement Agile is a concern for me. In reality Agile is the new Waterfall (or Wagile as I call it) and I have a real issue with the industry that has grown up around it.

Formal certification requirements, complicated frameworks for scale, a lexicon that excludes the Business and ceremonies that are similar to a cult, make adoption a challenge.

Adherence trumps change and that is not just disheartening. As a CIO mandated to bring about change that is precisely what we don’t need if we are to confront today’s ultra-tough innovation requirements.

Looking back at those heady days in the 90’s, from what I understand, software developers were debating how to become more agile and to do so they explored many different ways of working. Then Scrum became popular amongst Teams; communications improved and delivery benefited from greater agility. But the reference point was Waterfall, a method that was regularly leading to large scale failures. Yes, Scrum/Agile were more efficient than this. But “less broken” doesn’t mean “fixed”.

And don’t get me wrong, I have no issues with Agile. In fact, the methodologies emerged as upstarts confronting the Waterfall traditionalists and I love that. But things move on.

Unfortunately, Agile hasn’t benefited from ‘daily’ continuous improvement, which has always been the litmus test of a creatively lean and adaptive way of working. It has become a very formal methodology that teams must follow. Anyone wanting to join a Company that uses Agile, must either have formal qualifications or loads of experience of being immersed in the methods. No potential employee will receive any credit for wanting to constantly challenge Agile or wanting to improve it.

In my opinion the method, process, ways of working, techniques and rules of Agile are all frozen in time. Flow represents the complete opposite. As its name alone suggests it is about constant change, constant development, in the moment.

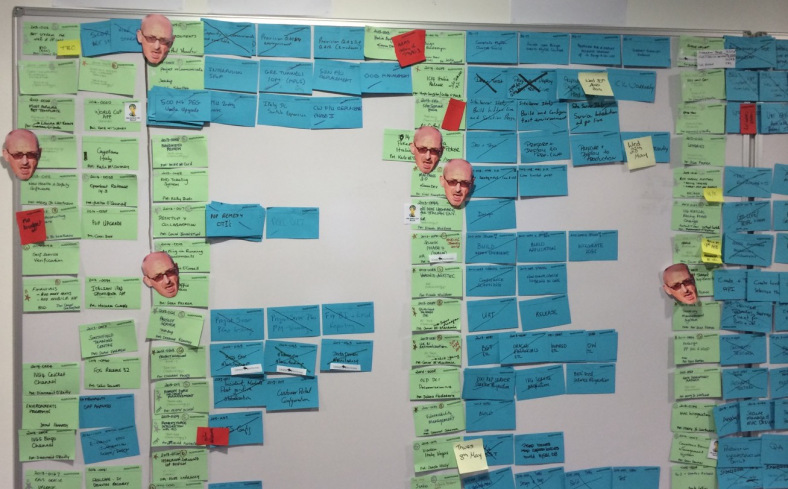

Flow isn’t constrained by any rules or certification courses. it is a philosophy for responding to the current context. What we care about is an efficient flow of tasks that are small, easy to understand, easy to pivot and that facilitate frictionless progress towards a goal. Challenging blockers and adding anything that improves the flow is positively encouraged, especially from teams that we ask to be creative.

Hmm, it just occurred to me that Flow could be adopted for life in general!

While Flow currently embraces KanBan, DevOps and Continuous Delivery, it would, in principle, throw any of these methods in the bin and replace them all if something else emerged which delivers an improvement.

Decisions about how best to get something done are made by teams in the flow – not by some faceless curator of standards written a decade or more back.

Let’s explore this “team level” concept. No two Flow teams are the same, they each have steps which are appropriate to their goal and should have the autonomy to use any process or technique they see fit.

And Flow can be used for any context. There is no reason why one couldn’t use the principles of Flow,the visualisation of problems at a level of granularity where everyone understands their role and can contribute an innovation, for managing Customer complaints or indeed organising a Mainframe development team.

Visualisations, stand-up meetings, automation and continuous delivery shouldn’t be the preserve of start-ups who benefit from being Cloud native and not being weighed down by technical debt or years of legacy.

The provocation which Haydn and myself are making in our new book called Flow, is that people using our techniques can take any current process and are free to improve it by making everything visible, dismantling old fashioned hierarchies, being curious about change, absolutely ruthless about efficiency and demonstrating the courage to challenge the norms.

For me, the Emperor’s new clothes are being proudly being worn by Leaders in many of the leading companies in the world. And we want to you to join us in rethinking Agile.

Because Flow isn’t confined to anything, it’s relevant from the Board Room, throughout your organisation and all the way to the Customer.

Blog post by Fin Goulding, a marathon running CIO