Whether you live by your Twitter lists, save your Google Alerts or simply scroll through LinkedIn for insights and commentary – there is a wealth of content that weaves a global story around fintech. This week’s FTT Bookmark is brought to you by Laura Camplisson, Product and Content Manager at VC Innovations and features accessible banking cards, money management for kids and bank robbery fails.

HSBC and Alzheimer’s Society team up on accessible bank cards

The first story to catch my attention this week was the news the HSBC, together with the Alzheimer’s Society, will be producing a new range of accessible banking cards. The cards will support those with dementia, visual impairments, learning difficulties and dyslexia.

I was really pleased to see this important initiative, having personally witnessed the effects of dementia on completing ‘everyday’ actions like using a bank card. Suddenly something which is usually second nature – like putting a card into a reader the right way round – can become very challenging. Especially when the person impacted is from an older generation and has only had to adapt to using card payments very late in their adult life.

We’ve worked with @HSBC_UK to design a new range of vertical cards with features that will support people with dementia. The cards show which way to insert into readers and ATMs. Read more in @Finextra: https://t.co/4AV1DPIRJ0

— Alzheimer’s Society (@alzheimerssoc) August 12, 2021

The thoughtful design of the new HSBC cards will include an arrow at the top and notch at the bottom to indicate which way round it should be used. Tactile dots will help differentiate between credit/debit and personal/business bank cards, while contrasting colours and larger fonts will make details easier to read.

These changes will clearly help a whole range of customers, of all ages and abilities. The news follows Nationwide’s debut of a similar ‘dot and notch’ card, certified by the Royal National Institute of Blind People, so I am hopeful that such initiatives will become the norm rather than the exception.

I think it’s particularly important that HSBC will be adding the design features to all their cards, rather than those who need them having to ask for adapted products. Definitely a win for inclusion and accessibility this week and I hope more banks and fintechs will follow suit!

Knock Knock, Kroo’s There?

There could soon be a new challenger bank on the horizon, as London-based fintech Kroo has raised £17.7m in a Series A funding round. Currently Kroo offers a prepaid debit card account, with financial management tools for users to track their spending and split bills with friends, but today it has been announced that Kroo has received a banking licence and is now authorised (with restrictions) by the PRA and FCA.

This is a pretty big deal, making Kroo only the second new bank to be authorised so far in 2021. The start-up were winner of Best Newcomer at the 2021 British Bank Awards and clearly already have some really positive initiatives underway.

The Kroo website states, “we’re on a mission to build the world’s greatest social bank,” which appears to be through offering customers the ability to create payment groups with friends, track spending and split and pay bills, removing any anxiety or awkwardness around social transactions. The fintech also wants to helps reduce the friction around finances, improve people’s relationship with and management of their money and create access to fair loans.

Kroo also promises to invest part of its profits into social causes and plans to offset carbon emissions by planting one million trees. I’m very interested to see what’s around the corner for this promising new financial provider.

And finally this week’s wild card story… How not to rob a bank

A man from East Sussex has been sentenced to jail time, after several failed attempts at bank robbery over the past few months.

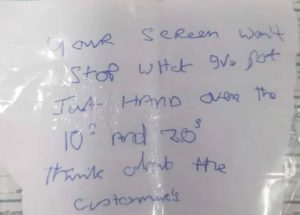

Unfortunately for Mr. Slattery, staff at Nationwide Building Society in Eastbourne were unable to read his handwritten note demanding they ‘hand over the 10s and 20s,’ as his writing was so illegible. In fact, his note was only deciphered and passed to the police after he had already left empty handed.

His second attempt proved slightly more successful, leaving him with £2400 of stolen cash from another local bank branch. That is until Mr. Slattery once again proved himself not quite cut out for a life of crime, after Police were able to track him down when he used his Senior Citizens’ bus pass to escape the crime scene.

The story is both amusing and, when you consider that the illegible note was written on a gambling slip, slightly tragic. At least bank staff and the public were unharmed, and the would-be robber has now been caught.

Next week its back to the Fintech Talents content team for their take on a week of Fintech news.